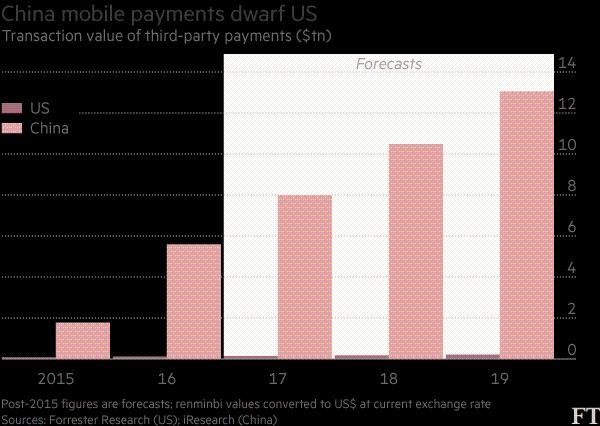

Market data shows that the size of China Mobile's payment in 2015 was nearly 50 times that of the United States. The popularity of China Mobile payment has benefited from the explosive growth of online financial services such as online shopping and online loan and online money market funds. More than half of China’s mutual funds are now available online. In 2012, this ratio was only 5%. China leads the United States in mobile payments and is also the result of the lack of other feasible non-cash payment methods. Compared with developed countries, China's credit card penetration rate is relatively low, and online payment using debit cards is cumbersome. Usually, multiple authentications such as SMS, U-Shield, and random passwords are required.

In contrast, paying with Alipay or WeChat is much simpler. You only need to scan the QR code from the retailer service point terminal or smartphone. In a report, eMarketer, a market research firm, said: “The near-end payment has been rapidly applied in China, benefiting in part from its subsequent advantages. Unlike the United States and other regions, China does not have a strong credit card culture. In fact, China jumped directly from cash payments to mobile payments."

CHERY Brake Disc

CHERY Brake Disc

Zhoushan Shenying Filter Manufacture Co., Ltd. , https://www.renkenfilter.com